Dedicated 1-on-1 Online CRE Coaching

Real estate finance made simple. We leverage experience in real estate investment banking and private equity to equip you with the skillset necessary to ace class assignments and conquer financial modeling case studies with confidence.

We’ve Worked with Students from…

…and They’ve Landed Roles at

Here’s What Our Trainees Have Said

Your Go-To Resource for Real Estate Finance

If you need help with any of these concepts, you’re in the right place

Net Operating Income (NOI)

Cap Rate (Capitalization Rate)

Cash-on-Cash Return

Internal Rate of Return (IRR)

Net Present Value (NPV)

Discounted Cash Flow (DCF)

Equity Multiple

Multiple-on-Invested-Capital (MOIC)

Return-on-Cost (Yield-on-Cost)

Unlevered Returns

Levered Returns

Pro Forma

Rent Roll

Potential Gross Income (PGI)

Effective Gross Income (EGI)

Operating Expenses

Stabilized NOI

Rentable Square Feet

Vacancy & Credit Loss

Rent Escalation

Rent Concessions

Expense Reimbursements

Renewal Probability

Absorption & Turnover Vacancy

Tenant Quality

Lease Abstract

Goal Seek

Loan-to-Value Ratio (LTV)

Loan-to-Cost Ratio (LTC)

Debt Service

Debt Service Coverage Ratio (DSCR)

Debt Yield

Loan Constant

Interest-Only Period

Balloon Payment

Exit Cap Rate

Federal Reserve

Development

Development Budget

Development Spread

Disposition Fee

Refinance Proceeds

Breakeven Occupancy

Preferred Return (Pref)

Preferred Equity

Sponsor Equity

General Partner

Limited Partner

Capital Stack

Waterfall Distribution

IRR Waterfall

Private Equity

Scenario Analysis

Sensitivity Analysis

Full-Service Lease

Gross Lease

Modified Gross Lease

Triple Net Lease (NNN)

Double Net Lease (NN)

Percentage Rent

Expense Stops

Base Year Stop

CAM Charges

Replacement Reserves

Untrended and Trended Rent

Tenant Improvements (TIs)

Leasing Commissions (LCs)

Market Rent vs. In-Place Rent

Fixed & Variable Expenses

Bridge Loan

Terminal Value

Ancillary Income

Rent Escalation

Rent Concessions

Sources & Uses

Absorption & Turnover Vacancy

Operating Shortfall

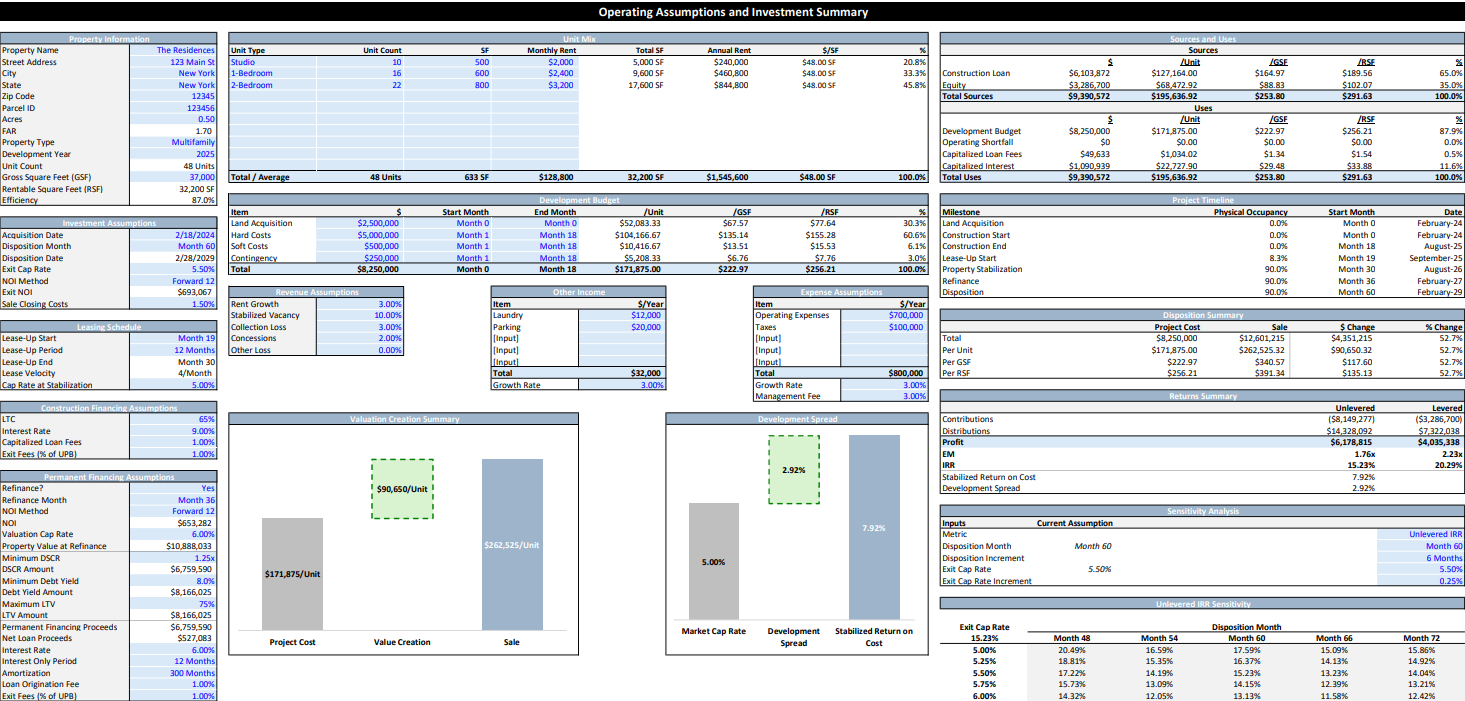

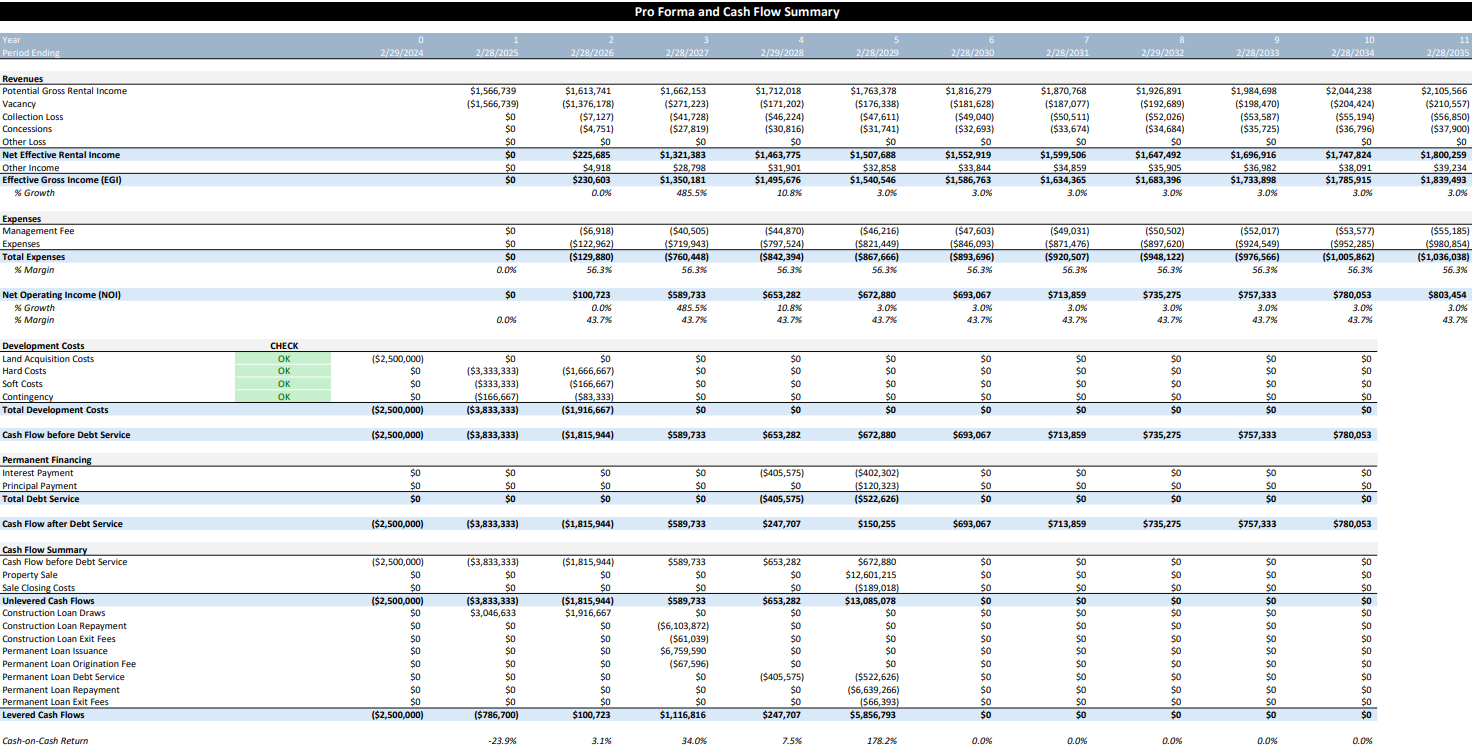

Case Study

Capstone Project

Offering Memorandum (OM)

Profit

Excel Shortcuts

Financial Modeling

Federal Funds Rate

Draw Schedule

Loss to Lease

Collection Loss

Acquisition

Core

Core-Plus

Value-Add

Multifamily

Office

Industrial

Retail

Hotel

Self-Storage

Going-In Cap Rate

Construction Loan

Soft Costs

Hard Costs

Amortization

Base Rent

Stabilization

Refinance

Weighted Average Lease Term (WALT)

Total Returns

And Many More…

Our Services

-

Coursework Tutoring

Struggling to understand concepts from class? We break them down to help you ace your homework assignments and exams. You keep the solution file.

-

Career Advancement

Already applying to real estate investment firms? We prepare you for the entire process. And don’t worry, we have many case study examples.

Who We Are

Experts in Real Estate Investment Finance

We’re here to make real estate financial modeling and investment analysis seamless. With certifications like the Series 63 (Uniform Securities Agent), Series 79 (Investment Banking Representative), SIE (Securities Industry Essentials), and a New York State real estate license, we bring real industry experience to the table — not just theory. Our background includes a degree in economics from Middlebury College and experience on over $1 billion in real estate transactions across asset classes like multifamily, office, retail, hotels, and more. Whether you’re struggling with class concepts or gearing up for interviews, we’re here to help you feel confident and ready.

See It in Action

1-Hour Retail Acquisition Case Study (Live Modeling w/ Excel Shortcuts)

Here’s a video showcasing how to effortlessly complete a simple 1-hour acquisition model from scratch — with Excel shortcuts and dynamic formulas. The output is an institutional-quality real estate financial model, representative of the type of models you need to create to ace your courses and land offers in real estate private equity. We will get you to this level and beyond.

Pricing

Individual

$125 / 1-hour

Sessions start at a 1-hour minimum, with no maximum. Need more time? You can add in 30-minute increments — like 90 minutes or 2 hours — depending on what you need. Payments are due upon securing a time slot. Each session is fully personalized to your goals and learning style, whether you're working through a homework assignment, prepping for an interview, or leveling up in commercial real estate finance. We meet virtually on these platforms:

We accept payment through the following payment apps

Group Session

$90 / 1-hour / attendee

Frequently Asked Questions (FAQs)

-

Sessions are tailored to your goals and needs. Some students prefer to see the problem solved and then followed up with a review, other prefer us to correct their mistakes. We do not cover material related to obtain your real estate salesperson license.

-

Self-Taught CRE is built for career switchers, undergrads, graduate students, recent grads, analysts, associates, and entrepreneurs looking to break into or advance in real estate investment, development, or private equity. We've supported students in MSRED, MBA, MSIRE, MRED, and undergraduate programs. No prior experience needed — we meet you where you are.

-

Each session is 100% personalized. We typically work together over Google Meet or Zoom. You receive all files at the end of the session.

-

Things come up. We have worked with investment bankers, parents, police officers, flight attendants, and people from all walks of life. Cancel or reschedule the first time, no big deal. After that, we do retain the amount you paid for your session.

-

If a slot is available, we do accommodate same day sessions. Historically, an hour is more than enough time for us to be prepared to meet with students.

-

We operate in Eastern Standard Time (EST) and are based in New York City. With that being said, we have worked with several students in California and even as far as London. Work with us and we’ll work with you.

-

The vast majority of sessions happen online via Google Meet and occasionally Zoom. In person sessions are strictly limited to New York City, Nassau County, and Westchester County.

-

No. You also don’t have to put your camera on. We have worked with some students for literal years and have no idea what they look like.

Start Working with Us

The Process Is Simple

There are two ways to get started:

1. Schedule a Free 15-Minute Call

In this focused session, we’ll review your project or assignment, identify the key roadblocks, and outline the exact steps to solve them. If we agree it’s a fit, we’ll confirm your service package and begin immediately. This call is for students and professionals who are ready to take action and see results now.

2. Email Us Directly

Email us directly at info@self-taughtcre.com.