Internal Rate of Return (IRR) and Net Present Value (NPV) - Two Sides of the Same Coin

IRR vs. NPV in Real Estate: What’s the Difference?

If you’re building a real estate financial model or preparing for an interview, chances are you’ve come across two core metrics: IRR and NPV. They’re both used to evaluate investment opportunities — and both rely on the Time Value of Money — but they answer different questions. Make no mistake though, they will result in the same conclusion. If you never come back to this post again, just remember this:

If the IRR is greater than your Required Rate of Return, then the NPV is positive ; If the IRR is less than your Required Rate of Return, then the NPV is negative; If the IRR is equal to the Required Rate of Return, then the NPV is equal to 0.

IRR Tells You the Rate of Return

IRR, or Internal Rate of Return, shows the average annual return you’d earn on an investment based on its projected cash flows. In real estate, IRR is used to evaluate how efficiently a project grows investor capital over time.

If the IRR is higher than your required return (often called the “discount rate”), the deal is considered attractive.

NPV Tells You the Dollar Value Created

NPV, or Net Present Value, tells you the total value created by a project — in today’s dollars (aka Present Value) — after accounting for your Discount Rate (The Required Rate of Return). A positive NPV means the investment is expected to outperform your return target. A negative NPV means it’s falling short.

Practitioners versus Academics: The Relationship IRR and NPV explained

Ask anyone you know who studied finance in college and then landed an investment level role - the two worlds have noticeably different approaches.

Academically, IRR is defined as the discount rate that makes the Net Present Value (NPV) of an investment equal zero. It’s a helpful way to connect the two concepts and is important to understand for exams or interviews. In practice, real estate analysts don’t calculate IRR by solving for NPV = 0 — they use tools like Excel’s IRR function to get a quick estimate of a deal’s annualized return. IRR is interpreted as the return the project is expected to generate, while NPV tells you how much value is being created above your required return. So while the academic definition explains why IRR and NPV are connected, most practitioners focus on using IRR as a benchmark and NPV as a dollar-value check.

It’s less about the math, more about understanding how efficiently your capital is working.

Two Sides of the Same Coin

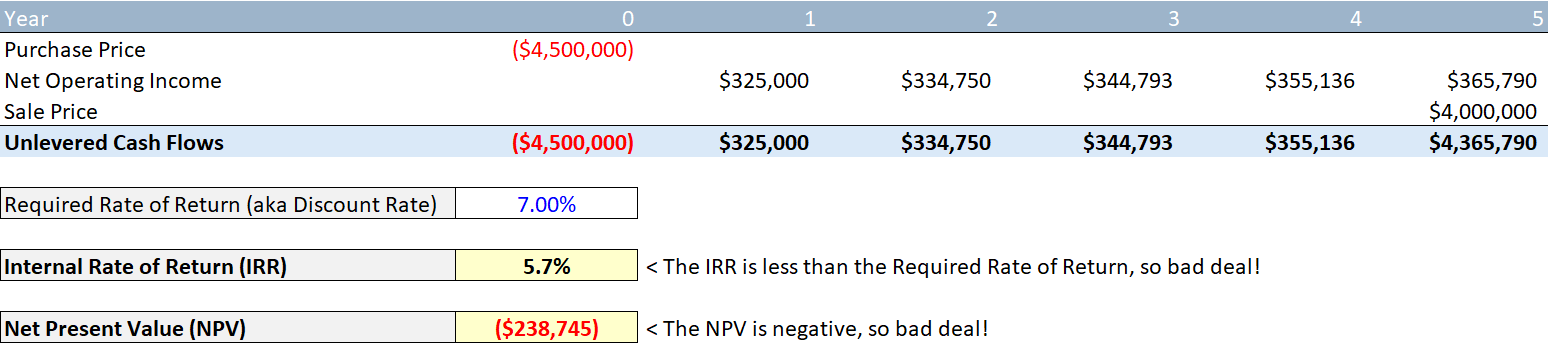

Let’s now calculate the IRR and NPV for a good deal, a bad deal, and then set the NPV’s Discount Rate to the IRR to see the results:

Here’s the good deal. Both metrics lead to the same conclusion.

Here’s the bad deal. Both metrics lead to the same conclusion.

When the Discount Rate is set to the IRR of the investment, the NPV is 0. This is what professors want you know. Will a principal at a private equity fund care? Good to know, but not the highest priority.

Key Takeways

Both IRR and NPV are essential tools in real estate financial modeling — and understanding the difference between them is what separates basic analysis from real decision-making. IRR tells you how efficiently your capital is being returned over time, while NPV tells you how much value the deal creates today.

You don’t need to master every technical detail right away. What matters is knowing when to use each metric, how to interpret them, and how to explain your thinking with confidence.

If you’re still unsure which one to rely on — or how to calculate them correctly in your model — schedule a 1-on-1 session and get expert support tailored to your learning.